The Disappearance of Kendra Nicole Battelo in Enid, Oklahoma

Kendra Battelo walks into a room and people look. She is beautiful, but what people really notice…

Kendra Battelo walks into a room and people look. She is beautiful, but what people really notice…

Adams was last seen at the Artesian Lounge in Herculaneum, Missouri on July 25, 1976. She asked…

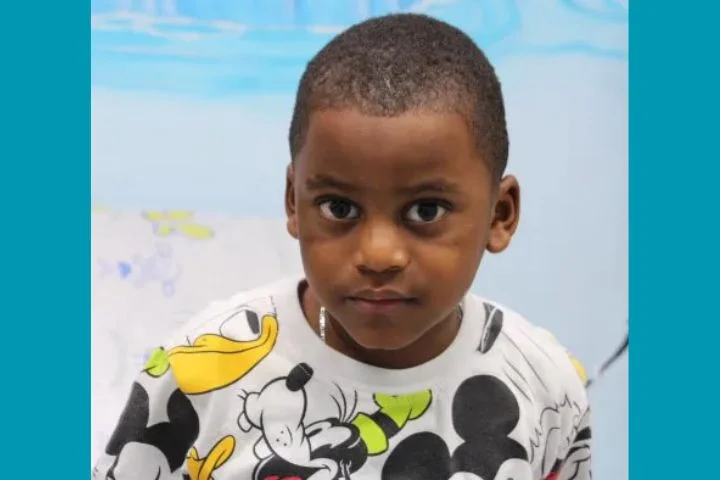

A Davenport mother was accused of kil*ling her young son in a “horrible” m*urder. In a news…

Stephan Mitchell Adams called his girlfriend on his cellular phone at 11:00 a.m. on December 13, 2004…

It was a beautiful summer day on July 25, 1985. Two sisters, Rozlin Rochelle Abell, 18, and…

23 year old Phoenix Coldon was last seen leaving her family home in the 12600 block of…

Deputies responding to a disturbance call at a Florida apartment complex burst into the wrong unit and…

26-year-old Kennedy Walton was last seen in Saint-Louis, Missouri on March 4, 2022. She disappeared after spending…

The sister of a 19-year-old Oklahoma teen found d*ead along a highway believes people are withholding information about what…

The brother of an Oklahoma teen mysteriously found de*ad on the side of the highway says he fears someone…